Embracing Globalization | Far East Horizon Advancing at an Accelerated Pace

The new era has come, calling for a new mission. With “gathering global resources to help Chinese enterprises” as its mission, Far East Horizon has been playing a dual role to attract capital for mainland companies and help Chinese enterprises to go global. In the future, it will continue to integrate domestic and overseas resources, expand its global assets layout, and carry on its international journey steadily and sustainably.

Hong Kong is one of the world’s most mature and internationalized markets. In recent years, the return of China Concept Stock and a constant flow of emerging industrial companies have infused it with vitality continuously. Taking full advantage of the “bridgehead” Hong Kong, Far East Horizon keeps innovating service means, enriching the connotations of service, and exploring “globalization of operation.”

In the aspect of finance, Far East Horizon has set up a specialized platform for offshore financial business in Hong Kong. Through sufficient interactions with various industry sectors within the Company as well as the international financial market, it provides various modes of integrated services for corporate clients with needs for offshore investment and financing operations. Based on client needs, its products have advantages including high approval efficiency, flexible term structure and one-stop service, which can help enterprises efficiently replenish working capital, implement overseas mergers and acquisitions and upgrade technology.

Upon approval by the Securities and Futures Commission of Hong Kong, Far East Horizon’s business in Hong Kong has received the Type 4 license for “advising on securities” and the Type 9 license for “asset management,” and thus tremendously enhanced the continuity and scale of its international operations. As a license holder, Far East Horizon has significantly enriched the scope of clients’ investment targets and satisfied their needs for diversified asset allocation and cross-border asset allocation through the provision of a series of offshore investment products, including hedge fund, equity fund, bond and derivative investment. Meanwhile, based on the Group’s cross-border linkage advantages, Far East Horizon can serve global clients with the allocation of quality Chinese assets while bringing more diversified global resources to Chinese enterprises.

According to its planning, Far East Horizon will keep expanding domestic and offshore licensing business in areas including security brokerage and institution financing, fully interact with the international financial market, continuously consolidate and broaden the channel for linking up domestic and foreign funds and quality assets at home and aboard, and provide more financial products and professional financing services to clients.

In the aspect of industry, with the advancing of the Belt and Road Initiative, Horizon Construction Development—Far East Horizon’s subsidiary platform for integrated equipment operation services—has seized the opportunity to gradually expand its overseas business layout and revitalize its equipment assets at home and abroad. At the present stage, in addition to Hong Kong, Horizon Construction Development has been conducting business exchanges and cooperation with a dozen of Southeast Asian and Middle Eastern countries and regions including India, Thailand, Vietnam, South Korea, Singapore, Saudi Arabia and the United Arab Emirates; also, it has been setting up companies in Singapore, Malaysia and Vietnam step by step, to set the foundation for further exploring overseas assets full life-cycle management, investment and mergers & acquisitions.

Over the years, thanks to the location advantages of Hong Kong, Far East Horizon has maintained frequent interactions with the international capital market. Researched and promoted by multiple international investment banks including Citibank, J. P. Morgan, UBS, HSBC, DBS, UOB KayHian and Mizuho Securities, it has been included in 14 Hang Seng Indexes like HSSCHK, HSLMI and HSHKI, and it is also a constituent stock of index series such as MSCI China Index and MSCIEF.

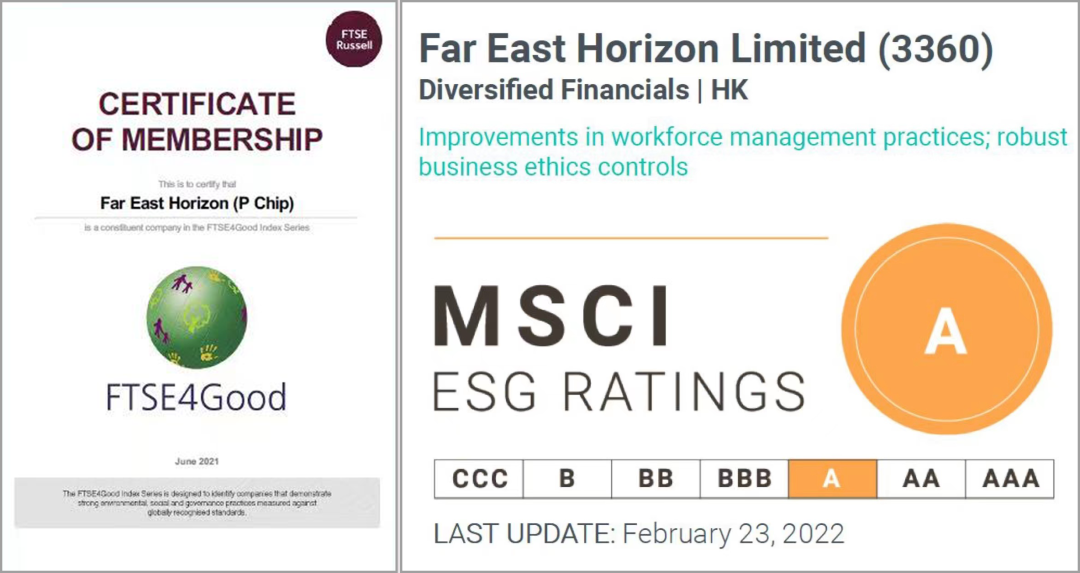

As a modern enterprise with an international perspective, Far East Horizon has received the recognition of international institutions with its achievements in ESG practice: it has been added to the FTSE Global Equity Index Series for years consecutively and received a rating of A in the Morgan Stanley Capital International (MSCI) ESG Ratings, reaching the leading domestic level among Chinese financial institutions.

As the Company enters a new stage of globalization strategy, its human resources philosophy has been updated to “talent internalization and cultural diversity.” Far East Horizon will continue to adhere to the market-oriented talent philosophy, strive to create a just, fair and open arena for professional competition, and attract more quality talent from around the globe.

In the future, Far East Horizon will continue to deepen the strategy of “integration of global resources and globalization of business operation.” Based on Hong Kong as the international hub and Shanghai as the domestic hub, it will expand its global operations with the two hubs interlinked, and devote itself to creating value for clients and partners around the world sustainably, effectively and continuously.